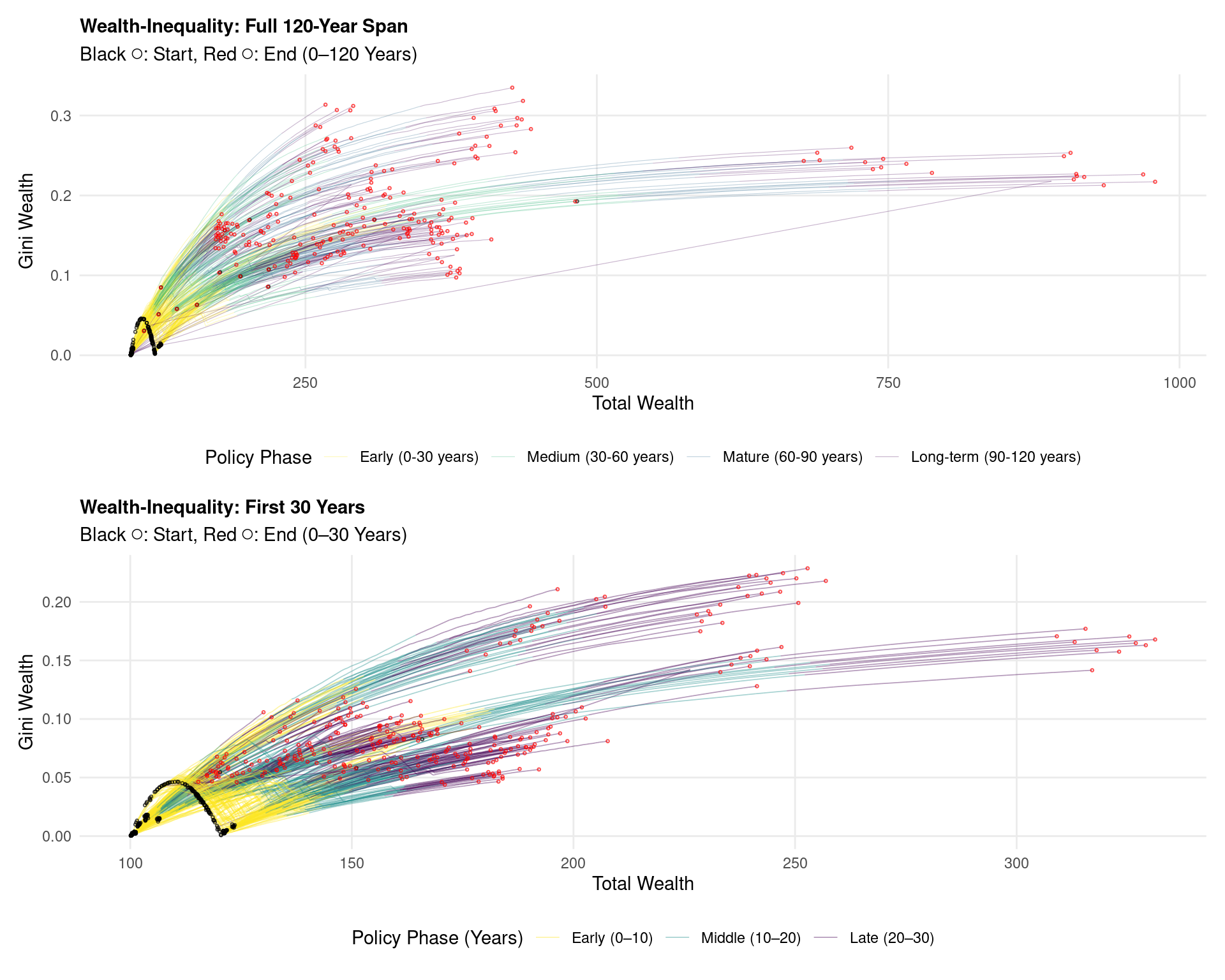

Mitigating Inequality Under Commodity-Price Shocks

Agent-based model of household responses to commodity price shocks, simulating 100 heterogeneous agents with Cobb–Douglas production. Uses Ornstein–Uhlenbeck price dynamics, with policy sensitivity analysis via penalized GAMs and k-means clustering to evaluate impacts on inequality and wealth accumulation.

Understanding Household Resilience to Commodity Price Shocks

This project explores how agricultural households in developing economies respond to global commodity price shocks, with a specific focus on how different farming practices may help households maintain well-being during volatile market periods.

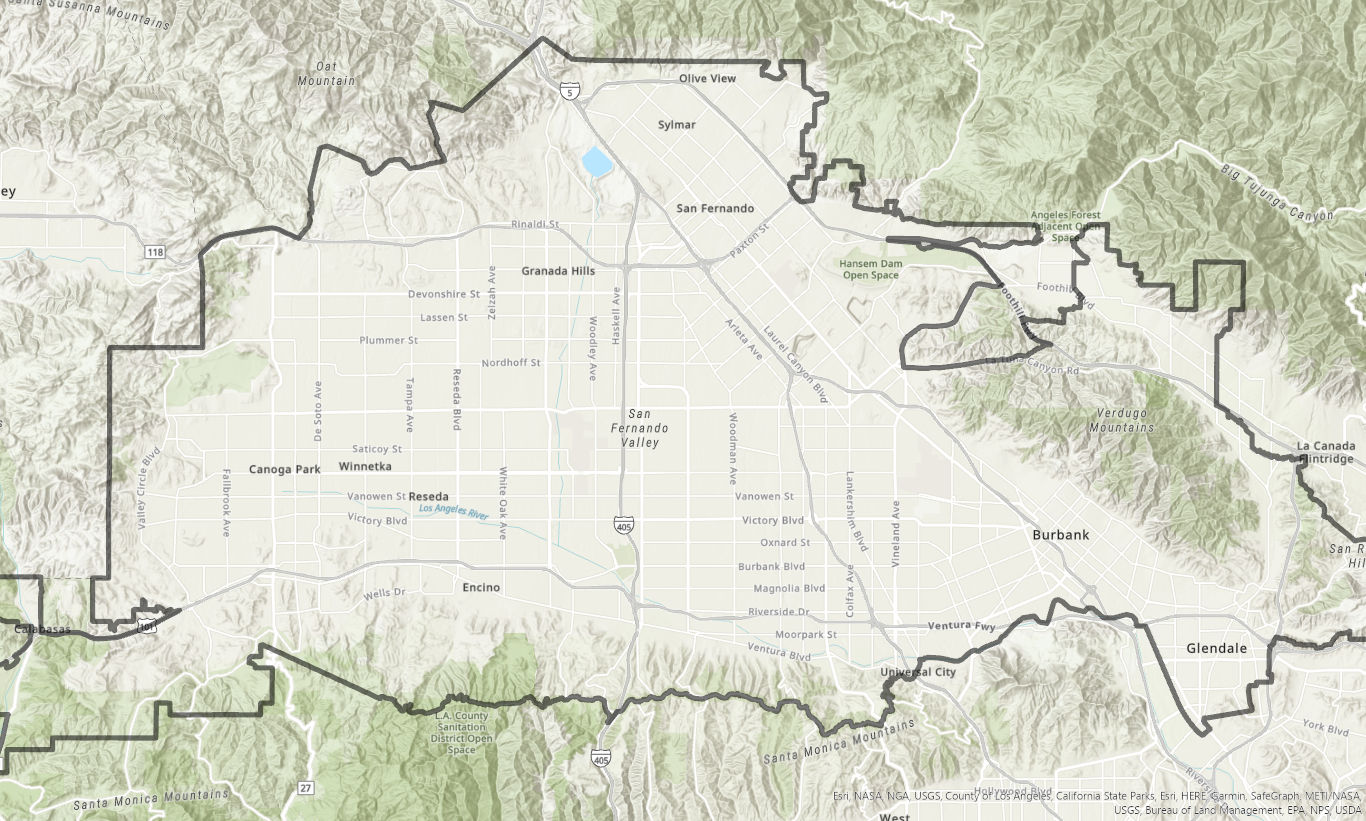

Green Spaces, Temperature and Pollution in the San Fernando Valley

Starting in the mid 20th century, the San Fernando Valley in Southern California began to transition from a mostly agricultural center to what is now one of the countries largest suburban areas.

Portfolio Build & Deployment

In additon to highllighting specific projects, this portfolio website is also a live demonstration of my skills in DevOps, cloud automation, and reproducible publishing workflows.